If you need to open a bank account, being well informed and ready-to-go with the right documents will save you time and money. There are a few steps you’ll want to follow to make sure you’ve made the right choice. If you’re wondering what you need to open a bank account, here’s everything you need to know.

To get started, you need to make sure you’re eligible to open an account. You’ll need to be at least 18 years old and have a social security number in most cases. For those between 14 and 18 years old, the account must be opened with a parent or legal guardian as the co-owner of the account. If you meet these basic requirements, keep reading about what else you need to know.

How Much Money Do You Need to Open a Bank Account?

Many people want to know how much is it to open a bank account. Most banks don’t require much to open one. Most online banks don’t have a minimum initial deposit. At many credit unions, it’s as little as $5. It’s best to ask the bank about their minimum opening balance requirements to find out how much is it to open a bank account.

Even if you don’t need very much money to open a bank account, watch out for monthly minimum balance requirements. Some banks may charge you a service fee if your balance falls below their minimum balance amount.

How to Open a Checking Account

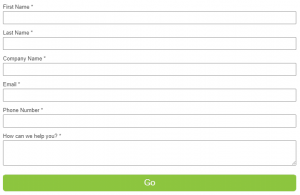

What do you need to open a bank account? Regardless of what type of account you choose to open, you’ll need to fill out an application. You’ll need to sign a signature card (that can be accessed by the bank to verify it’s you) at the local branch or mail one in to your online bank.

To open a checking account or any other type of account, you’ll also need the following:

- A government-issued photo ID like a driver’s license, state-issued ID or passport. Some banks may require two IDs. A birth certificate, social security card or a credit card in your name could serve as the second ID.

- Date of birth.

- Opening balance. Depending on how much your bank requires, be prepared to bring in cash or a check to fund your new account. Checking and savings accounts don’t normally require more than $25 to open one.

- Physical address. Although you can provide a mailing address, a street address is required under federal law.

- Social Security Number (SSN) or Taxpayer Identification Number (TIN).

When opening a checking account, be sure to ask for a debit card. Checks are optional and can be ordered for a fee but with online bill pay and a debit card, you could probably skip ordering checks. You may also want to apply for a credit card if you have good credit.

Don’t forget to request a direct deposit form with your information filled in. You’ll need to give it to your employer to have your paychecks deposited straight into your checking account for free.

How to Open a Savings Account

To open a savings account you’ll need the same items as listed above for a checking account. Savings accounts are limited by the Federal Reserve to six withdrawals and/or transfers total per month. If you have an existing checking account, you may want to link the accounts to make the transfer of funds between the two accounts easier.

How to Open a Money Market Account

You’ll need the same checklist items from how to open a checking account above. Money market accounts usually require a higher minimum balance than a checking or savings account, so be prepared to fund your account with cash, a check or a transfer. A typical opening deposit could vary widely between $1 and $10,000. The larger the opening balance, the better the interest rate.